There is no doubt that the future is connected, but what exactly is the role of telematics in the transportation industry and its developments – today and into the future.

With the world recovering from the coronavirus pandemic that left no one spared in 2020, telematics solutions gained more recognition, as the crisis hit businesses and their modus operandi. With the new reality of social distancing, contactless deliveries, and alternate ways of doing business, many have decided to create a new arm of their business with curbside drop-off or modify their existing fleet operations to be able to comply with stricter health and safety requirements – for customers and staff alike.

As more businesses rely on vehicle fleets today, the automotive industry is seeing an uptick – in some sectors more than others. The reliance on state-of-the-art technologies is higher than before, and its accessibility for small-to-medium businesses has been sped up.

As such, fleet managers can expect a lot of changes, with new technologies emerging in the coming years, together with the oncoming wave of fleet electrification, autonomous driving, and higher interconnectivity.

Here are 4 prominent telematics trends you should keep your finger on the pulse of.

Telematics & Electric Vehicles

While electric vehicles (EV) comprise a small percent of the current vehicle market, we expect them to become more prominent in the next decade.

In Europe, EV is entering a new popularity phase, with more opportunities arising in select market clusters. Governments are promoting EVs across Europe by providing a range of subsidies and other benefits, both on the demand and supply side, according to a McKinsey study.

Despite the COVID-19 crisis, electric vehicle sales could reach a record share in the automotive sector in 2020. In France, Germany, Italy, and the UK – the largest European automotive markets – combined sales of electric cars in the first 4 months this year were about 90% higher than in the same period last year.

According to a recent study by Fortune Business Insights™, with increased adoption, the global electric vehicle market size is projected to reach 40.6 million units by the end of 2026.

According to a new study from BloombergNEF, by 2040, EVs will account for 31% of all passenger vehicles on the road. Another important finding in the same study states that 58% of global car sales will be electric by 2040 — and over half of all passenger vehicles sold will be electric.

Scooters, motorcycles, and municipal buses are already going electric at an accelerated rate. Light commercial vehicles (ex. delivery vans) are the next segment to be most affected by EV.

Where does telematics come into the equation?

With telematics implemented in an electric vehicle, you gain an accurate system of measurement. You can monitor and record real-world data in order to make well-informed decisions and not rely on general assumptions, which will limit the ability to accurately measure benefits, such as cost savings and vehicle’s operational range. Key metrics will revolve around:

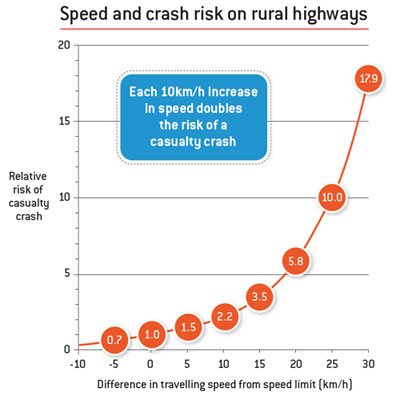

- Driving style – particularly aggressive on-road habits that speed up vehicle wear and tear, reduce tire pressure faster, add to the maintenance concerns and costs, and are simply hazardous to the public

- Battery status to maintain optimal charge levels

- Energy consumption per kilometre

Telematics & Autonomous Vehicles

Autonomous driving could dramatically reshape road transport over the coming decades.

Autonomous vehicles enable independent mobility for non-drivers, as well as people suffering from certain disabilities. They allow travelers to commute with more comfort and flexibility to read, rest, or even work while traveling, increasing productivity. By reducing human errors, there are prospects of other benefits, such as improved safety, lower crash risks, and increased road capacity, which will significantly contribute to the adoption of these vehicles in the market, according to iea.org.

By 2040, shared mobility will represent 16% of all kilometres travelled by road, according to a BloombergNEF study.

Car sharing is likely to grow alongside the rise of autonomous cars, bringing significant changes to the fleet management industry. Car sharing can help fleet managers introduce new business models, more “green thinking”, cost savings, as well as shave off time to maximize efficiency.

The transportation industry is expected to see significant growth in the future, due to the rising adoption of autonomous vehicles in transportation.

At the same time, technology developers do see some challenges.

While we already see Level 4 autonomous vehicles (ability to drive without human intervention under specific conditions or preset routes) introduced for public testing by companies like Waymo and Yandex, offering autonomous taxis in dedicated areas, or the Urban Mobility project with self-driving minibuses in Europe, it is not soon that human supervision will not be required at all.

No technology is yet capable of full automation (Level 5) that is be able to adjust to all driving scenarios, in all road, weather and traffic conditions, and some experts claim this level might never be achieved.

How can telematics advance autonomous driving?

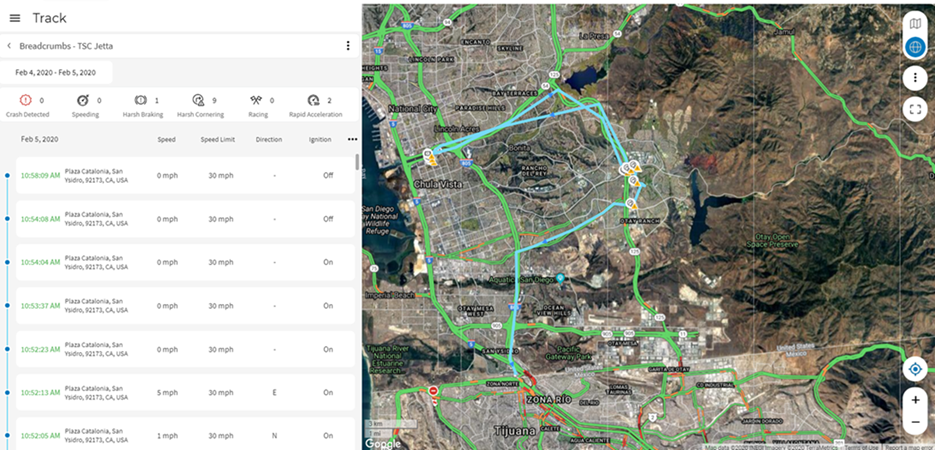

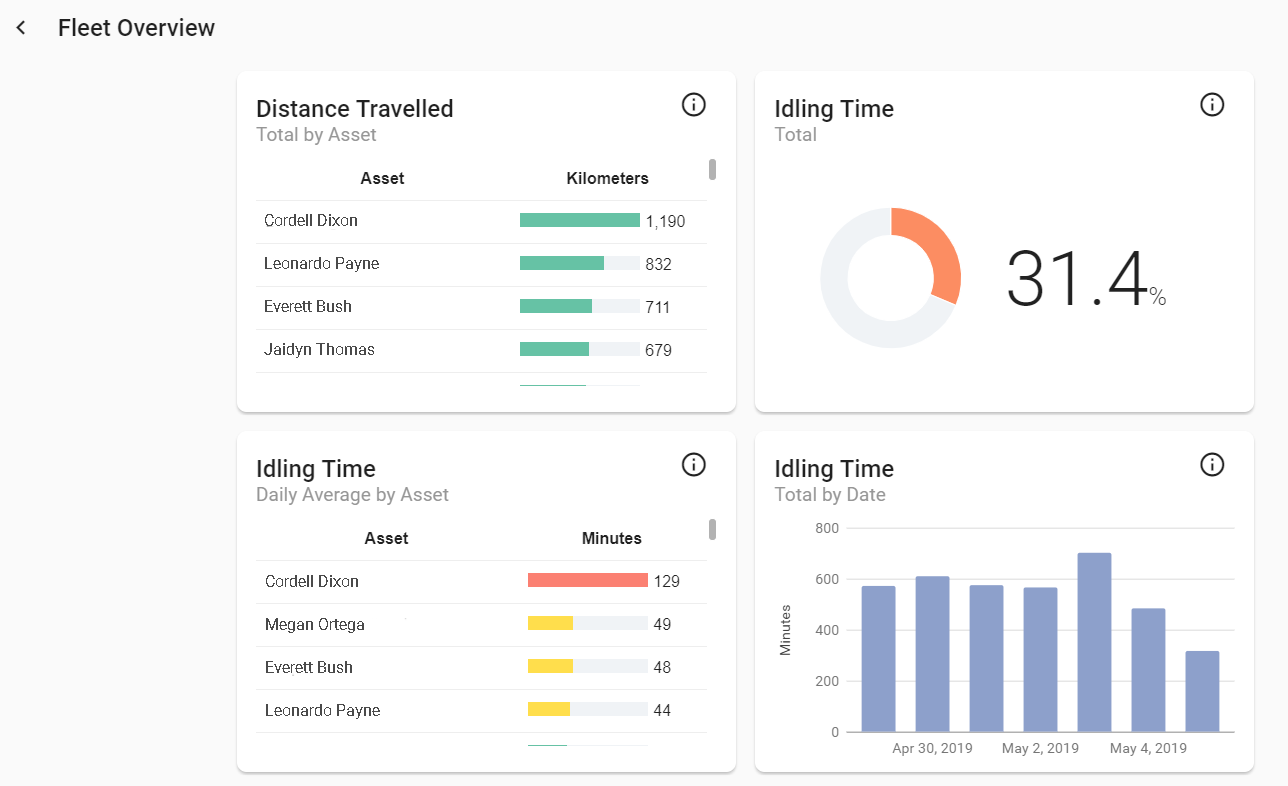

In order for autonomous vehicles to become mainstream, it has to go through many rounds of rigorous testing. Telematics addresses dynamic mobility management and is critical in measuring real-time vehicle data – location, speed, performance, routes, on-road behaviour (breaking, accelerating, cornering, lane-drifting), energy consumption, battery levels, estimated time of arrival and much more.

Telematics can leverage AI and predictive/prescriptive analytics to help determine when an autonomous vehicle will need servicing. In case of an emergency, it can send distress signals to the emergency response teams (even during an accident or breakdown) that could save valuable time.

Fleet Complete’s telematics platform, for example, is already being used for collecting feedback on self-driving minibus behaviour, performance, and maintenance in the European Autonomous Mobility project. The mobility solution consists of a mobility service planning module, passenger module, and smart bus stops. “Through the system, the public transport operator can design micro mobility services setting the service areas, fixed and dynamic routes, bus stops, pricing policies, and service schedules.’’

Telematics & Fleet Connectivity

With the emergence of connected services and the increased demand among fleet owners, telematics has become a key differentiator for the automotive manufacturers.

The advantage of integrated OEM (original equipment manufacturer) telematics is the ability to start collecting data from the vehicle as it comes ‘directly from the factory’, without the logistics of the aftermarket third-party solutions.

According to the latest Business Wire report on The Global OEM Telematics Market, it is estimated that over 41% of all new cars sold in 2018 were equipped with an OEM-embedded telematics system – up from 33% in 2017.

The number of telematics service subscribers using embedded systems will grow at a compound annual growth rate (CAGR) of 27.1 percent from 80.4 million subscribers at the end of 2018 to 339.3 million subscribers at the end of 2024, according to Berg Insights.

Connected car services have evolved from being a “differentiating factor” to a “common feature” .Carmakers and car owners are starting to see the benefits of connected car services as a growing number of new vehicles are equipped with the technology, according to Berg Insight.

The benefit of OEM telematics for fleet managers includes:

- Solving for mixed fleet logistics with different vehicle models

- The ability to plan new fleet acquisition with telematics in mind

- Faster implementation, if your company has a long procurement process

Fleet Complete is one of the leading providers of integrated telematics in the market today, cultivating strong OEM partnerships with global market leaders, such as Cummins, General Motors, Mitsubishi Australia, and Toyota and, most recently, Ford.

Car Insurance and Mobile Telematics

Insurance companies are seeing a profit gain from the growing popularity of mobile telematics. It is predicted that around 70 percent of light-duty vehicles and trucks globally will be connected to the Internet by 2023.

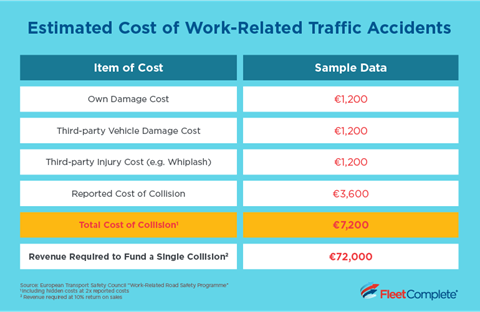

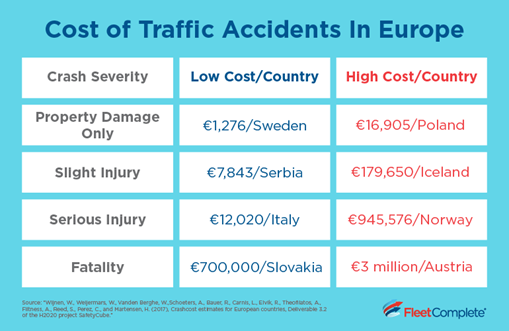

Insurance companies will have access to real-time data, which can be used to create even more accurate risk policies. Same data can be used to provide accurate insurance payouts, as they help insurers analyzing actual facts of road accidents, rather than relying on witnesses and testimonies.

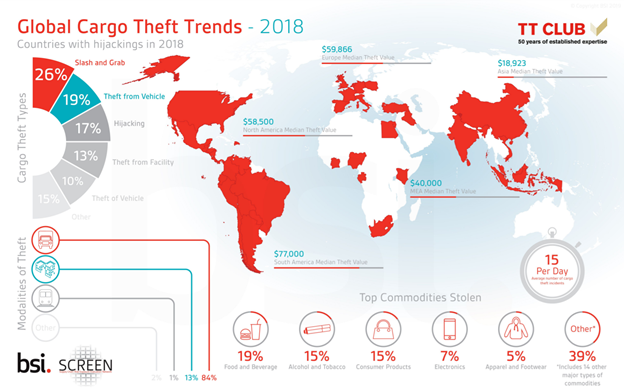

With the insights from telematics solutions, Fleet Managers can send real-time data to insurance companies to better assess driver behavior, as well as recover stolen vehicles, and ensure timely maintenance to avoid middle-of-the-road breakdowns and other safety hazards – all of which is guaranteed to spike your fleet’s insurance rate 2x-3x.

Be sure to choose a telematics partner with a vision for the future that will help your business grow.

If you want to keep ahead of the technology curve and prepare for a tech-savvy future that includes managing your fleet, learn more by requesting our Fleet Complete demo.

If you found this article helpful, please share it on social media via the links below.

Purchasing a fleet management solution for your business does not have to be a tedious effort. Consult one of our business solution specialists to learn more about the benefits of telematics.